We are scrambling in Houston trying to recover from Harvey. The Griffin Partners team is all safe, but some have completely lost their homes, and some have been flooded to the point that full recovery will take months. Both circumstances are major life disruptions. However, we are all grateful to be safe. Our prayers are now reserved for the families of those who lost their lives, 40 and counting as of this writing, and for the marginalized in our community who will experience considerably more difficulty rebuilding their lives. Many in the Griffin Partners family have volunteered at the shelters around the city and have seen firsthand how distressing it is for those individuals and families. It is all quite raw to us at the moment as flood waters have still not receded in some areas and traffic remains snarled. We may have some more thoughtful reflections next quarter with the benefit of time and perspective.

Q2 2017 Real Estate Market Thoughts

One thing we can comment on now is the exceptional performance of the Griffin Partners property management and engineering teams. All of our properties were exceedingly well prepared for the storm, and our team began the assessment and recovery process even before it was completely safe to return to work. Across the region, we had only one property with an inch of standing water in the building, and the remediation and recovery for that building is already well underway. A few other buildings had minor issues, and some below-grade garages experienced flooding. A couple of our Houston buildings were bone dry…………….on the inside!

Last quarter we reported that Fund II was formerly marketing for sale two of its eight remaining investments. One of those properties is under contract to be sold. The contract is still contingent, and we cannot predict how the buyer will react to Harvey. If the contract becomes firm, we expect it to close in November. We are currently working offers related to the other sale effort and expect that process to move forward. In addition to those two, somewhat surprisingly, we received an unsolicited offer for a third property, Bank of America Plaza in San Antonio (BOAP), and the sale of the BOAP was completed in mid-August. Fund II partners are receiving a distribution of the sale proceeds with this quarterly report.

Up to and including the enclosed distribution, Fund II has returned $19.1 million in distributions, equating to 83% of investors’ contributed capital, taking into account all distributions. Net asset value at the end of Q2 was estimated to be $14.2 million, net of the enclosed distribution, which equates to a multiple of approximately 1.5 to date. After realizing anticipated value accretion in the seven remaining Fund II investments, we continue to estimate the multiple will exceed 1.7 when Fund II is concluded. Assuming successful disposition of the asset currently under contract, we expect the cumulative amount of distributions to exceed total contributions by the end of this year.

Fund III has a property under contract to acquire in Houston and is close to securing opportunities in a few of our other target markets, including Denver and Phoenix. Fund III had its fourth closing in June and the offering period runs through October 31st. We continue to favor more defensive rent rolls with less vacancy than we typically seek out when investing earlier in the commercial real Estate (CRE) cycle. These types of CRE investment opportunities still have longer term promise for meaningful upside with primary value creation events two to four years out. As we have previously indicated, this more defensive approach for Fund III means a slightly larger portion of total return will come from cash flow, supporting Fund III’s current cash yield of 6%.

CRE Market Conditions

We receive data on our target markets from various sources, some of it on a quarterly basis from large national brokerages with research teams that track reams of transaction data, some of it on demand from subscription services to which we pay fees for access, and the balance from our own proprietary database to which we are constantly adding information about properties. On a semi-annual basis, our team reviews the market data in detail and produces our assessment of the current conditions in each of our target markets. We then use that assessment to guide our strategy and activities for both acquisitions and dispositions.

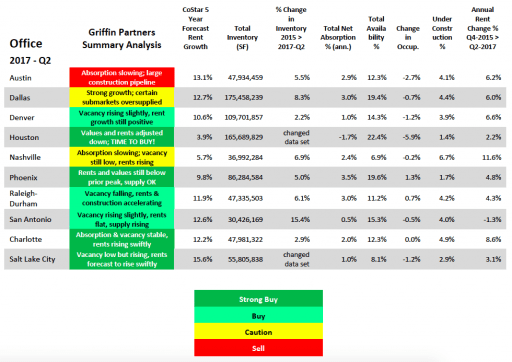

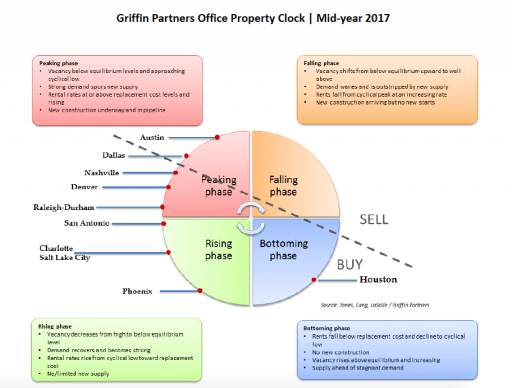

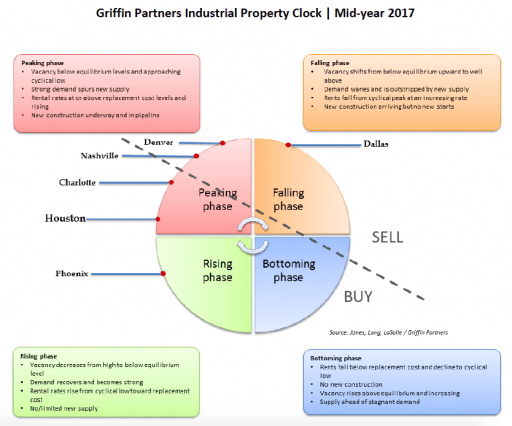

In previous Market Thoughts, we have belabored the point that different markets are at different stages in the CRE cycle. The global real estate services firm Jones Lang LaSalle illustrates these differences in a graphic called the “property clock,” which illustrates how different markets (cities) have some degree of non-correlation. Griffin Partners uses our semi-annual target markets assessment to construct our own property clock. A summary of this data for office and our most recent office property clock is shown below, followed by a similar summary and property clock for industrial.

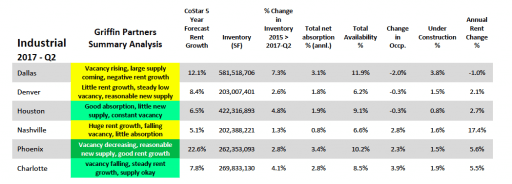

Here is the market data summary for industrial:

Macro-Econimic Conditions

Hurricane Harvey has interfered with our normal quarterly report process. As such, we are not including a detailed economic overview this quarter, but we promise to make up for it next quarter with copious amounts of keen insights and witty commentary!

What we did observe this quarter, at least for now, is a validation of the case we made last quarter for low inflation and continuing low interest rates in an overall benign economic environment. Global growth and manufacturing indices are healthy, US job creation remains consistent, yet wage growth is modest and inflation pressures are subdued. As of this writing, the US 10-year Treasury has fallen to below 2.10%.

So is the Phillips curve finally, completely dead? For our readers who are smart enough to not submerge themselves in the tedious, inexact and constantly changing elements of the dismal science, the Phillips curve is an economic theory postulating a tradeoff between inflation and unemployment that was all the rage in the 1970’s and 1980’s. Missing evidence of any Phillips curve effect is the big question being debated amongst economists and Fed watchers at present. We will tackle the question next quarter.